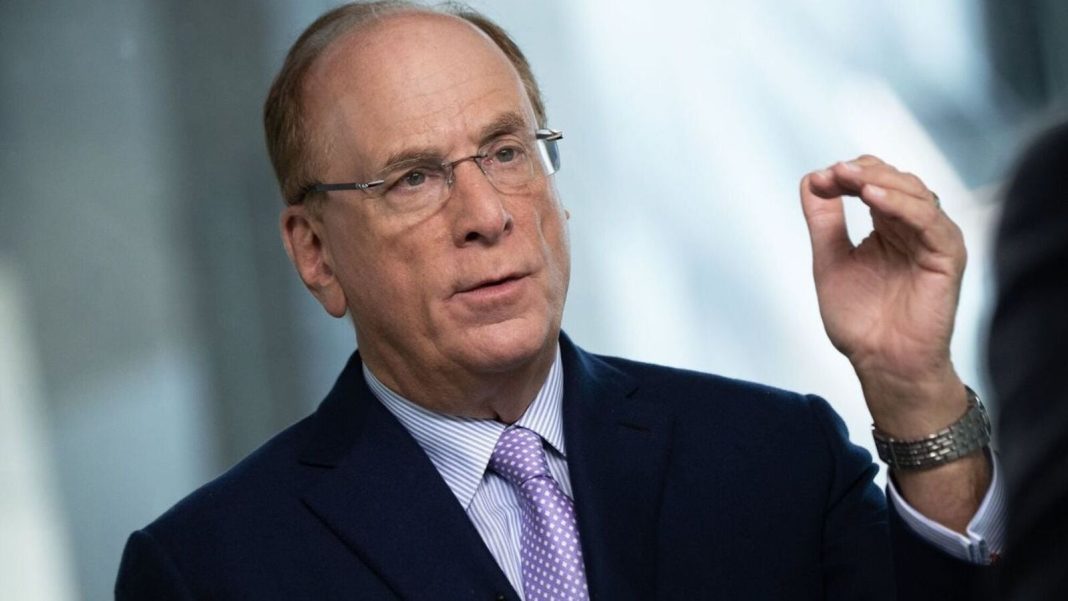

BlackRock CEO Larry Fink: Upcoming Election “Really Doesn’t Matter” for Financial Markets

In a bold statement that’s sure to raise eyebrows, BlackRock CEO Larry Fink has downplayed the significance of the upcoming U.S. presidential election, asserting that the outcome “really doesn’t matter” in the long run for financial markets. Speaking at a conference hosted by the Securities Industry and Financial Markets Association on October 21, Fink expressed his frustration with the media frenzy surrounding elections, suggesting that the focus on short-term market fluctuations is misplaced.

“I’m tired of hearing this is the biggest election in your lifetime,” Fink remarked, according to the Financial Times. His comments come at a time when the nation is gearing up for a closely contested election, with polls indicating a tight race between former President Donald Trump and Vice President Kamala Harris. Yet, Fink believes that the hype surrounding these elections often overshadows the more significant, long-term trends that truly impact financial markets.

Fink’s perspective is particularly relevant given that BlackRock manages a staggering $11.5 trillion in assets, with retirement funds making up more than half of that total. He emphasized that the day-to-day ups and downs of the market are less critical than many investors might think. “Unfortunately, there’s too much preoccupation with whether the market’s going up or down at any one time, any one quarter,” he noted. “It really doesn’t matter.”

This isn’t the first time Fink has shared his views on the relationship between elections and market performance. Just a few weeks earlier, at the Berlin Global Dialogue 2024 conference, he reiterated that while elections generate significant media buzz, their long-term effects on the markets are often negligible. “We see repeatedly every year, every four years, when we have an election, everyone says that it’s going to have a dramatic change in the market, and over time it doesn’t,” he explained. Fink’s assertion is that markets are resilient and adapt to changes, regardless of who occupies the White House.

As the November 5 election approaches, the stakes are high. Trump has proposed tax breaks aimed at boosting U.S. manufacturing, while Harris has outlined plans for greater government intervention in sectors like real estate and retail. With such contrasting visions for the future, one might expect heightened anxiety among investors. However, Fink’s comments suggest that he believes the market will ultimately find its footing, regardless of the election outcome.

In a world where political events often dominate headlines and influence investor sentiment, Fink’s perspective serves as a reminder to take a step back and consider the bigger picture. While the upcoming election may be generating a lot of chatter, Fink encourages investors to focus on the long-term health of their portfolios rather than getting caught up in the immediate fluctuations of the market.

So, as we head into this pivotal election season, it might be worth remembering Fink’s words: the market is more than just a reflection of political outcomes; it’s a complex system that evolves over time, often independent of who’s in charge. In the grand scheme of things, perhaps the most important thing investors can do is stay informed and keep their eyes on the horizon.